bpi express teller savings account application requirement|List of Account Opening Requirements : Pilipinas An all-digital BPI savings account that you can exclusively open using the GCash . Set a personalized wallpaper through the DIY entrance on the home page of our app. You can choose your prepared wallpaper resources to make, and we support four types of wallpaper custom: Photo, Video, 4D Parallax, and Gravity. We also have a wide range of Photo, 4D, and Gravity wallpaper backgrounds for you.

PH0 · What do I need to know before I start with my online application?

PH1 · Savings Accounts

PH2 · Regular Savings

PH3 · Open an Account Online

PH4 · List of Account Opening Requirements

PH5 · How to open BPI savings account 2023: online

PH6 · How to apply for BPI Savings Account

PH7 · How to Open BPI Savings Account: A Step

PH8 · How to Open BPI Savings Account

PH9 · How To Open BPI Savings Account 2023

PH10 · BPI open account requirements and app

PH11 · BPI Savings Account Requirements

PH12 · BPI Requirements and Process: How to

PH13 · BPI Account Types [2023]: Ultimate List of BPI Savings Accounts

Development Lotteries Board. DRAW NUMBER AND DATE MAIN DRAW SIGN RESULTS Special Draw/2 nd Chance

bpi express teller savings account application requirement*******Get all the help for your banking needs. We have a wide range of savings accounts that fit your individual needs, so you enjoy maximum convenience in safe keeping, managing and growing your funds.SaveUp - Savings Accounts | BPI - Bank of the Philippine Islands

Quick guides. If you have an existing BPI account, open an account online or visit .An all-digital BPI savings account that you can exclusively open using the GCash .*BPI Mobile option is open to existing BPI clients only. Terms and Conditions 1. A .Us Dollar Savings - Savings Accounts | BPI - Bank of the Philippine IslandsPadala Moneyger - Savings Accounts | BPI - Bank of the Philippine Islands

MAXI SAVER - Savings Accounts | BPI - Bank of the Philippine Islands

b) Php 2,000,000 for BPI Pamana Savings Account (peso) or USD 40,000 for BPI .

Quick guides. If you have an existing BPI account, open an account online or visit a branch near you. How to open a Regular Savings account online : 1. Select “Open a New Account”. 2. Tap “Open another deposit .Requirements for a BPI Account. You may open a BPI deposit account in any BPI branch with just 1 valid ID. For your convenience, we have listed sample identification .

A BPI account worth considering is BPI Direct’s Express Teller Savings. You can open an account for only Php 500. It also has a . Requirements in Opening a BPI Savings Account. 1. Two (2) Valid IDs. 2. Utility Bill. 3. 2 Latest 2×2 Pictures. 4. TIN Number. 5. Initial Deposit Amount. The Ultimate Step-by-Step Guide in Opening BPI .

1. Make sure you don't have an existing BPI deposit account before you proceed with your application. 2. Keep your valid ID nearby before you start. 3. Make sure your mobile .bpi express teller savings account application requirement Step 1 – Go to the nearest BPI branch. Step 2 – Choose the type of Savings Account that you want to open, then fill out the BPI Accoutn Opening Form. Step 3 – Submit the requirements and pay the . Below are the requirements to open a BPI account: Proof of billing (A credit card, internet, electricity, water, or any other billing statement.). Required initial deposit. A tax identification number (TIN) .

Open an account online in 4 easy steps. Step 1. Go to the app, tap "Open a new account", and tap "Create a bank account". Step 2. Fill out your personal details and account .

Here is a list of BPI requirements that we prepared: 1 valid ID with photo and signature. 1×1 ID Photo. Proof of Billing. Initial deposit. The valid ID should have your photo and signature on it. The proof of billing .

Enjoy cashless shopping in over 45,000 merchants nationwide through the Express Payment System . Conveniently request a new debit card or debit card replacement via BPI online or app. . ® from online threats with the help of BPI MS. LEARN MORE. Account Linking. Easily access your other card-based deposit accounts in just one .bpi express teller savings account application requirement List of Account Opening Requirements Existing BPI customers with a BPI deposit account, credit card, or loan can register for BPI online. If you don’t have any of these yet and you are a Filipino citizen that is above 18 years old and has a permanent address in the Philippines, you can easily open a BPI #SaveUp account and register for BPI online through the BPI app.

Step 1 – Go to the nearest BPI branch. Step 2 – Choose the type of Savings Account that you want to open, then fill out the BPI Accoutn Opening Form. Step 3 – Submit the requirements and pay the Initial Deposit. Step 4 – Wait for your Savings Account to be activated within 24-48 hours and claim your ATM card within 7 days.List of Account Opening Requirements BPI Save-up Automatic Savings Account. Dapat may existing at active na account sa BPI. 0 initial deposit. P1,000 maintaining balance kada buwan. P3,000 daily balance para kumite ng interes. 5% – 0.8% interest rate per annum depende sa klase ng account.

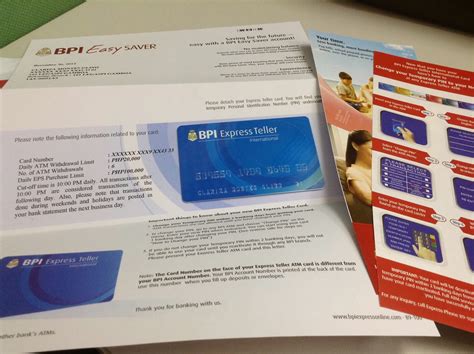

6. Choose "Saver-Plus with Debit Card". 7. Read and agree to the terms and conditions . 8. Tap "Confirm". 9. Fund your BPI Saver-Plus account. Save at least Php 100,000 to start earning BPI Rewards Points. 200 pesos for initial deposit (Add 50 pesos for ATM card) Initial deposit of 200 pesos is required to open BPI Easy Saver account. When your account is activated, that amount should be part of your account balance. I chose to have an Express Teller Card (ATM Card) instead of passbook, and that card costs 50 pesos.

Visit the BPI branch near you. Approach the teller in the “New account section” and inform the staff that you want to open a savings account. Prepare the needed requirements. Fill out the application form given by the employee. Pay the initial deposit depending on your chosen savings account. Wait for your account to be activated.

Go to the app, tap "Open a new account", then tap "Create a bank account". Step 2 Enter your personal details and account options, take a photo of your Driver's License, Passport, Postal ID, SSS ID, or UMID, then take a selfie to verify your identity.

Search this site. Skip to main content. Skip to navigation

1. BPI Kaya Savings Account; 2. BPI Express Teller Savings Account; 3. BPI Save-Up; 4. BPI Jump; 5. BPI Maxi-Saver; 6. BPI Passbook Savings Story; 7. BPI Pamana Savings Account; Requirements in Start a BPI Savings Account. 1. Two (2) Validated IDs; 2. Utility Bill; 3. 2 Latest 2×2 Pictures; 4. TIN Number; 5. Initial Deposit Measure; The . Maghintay habang pinoproseso ng teller ang iyong BPI account application. Kapag tapos na, magbayad ng required na initial deposit base sa napili mong savings account. 4. Hintayin ang activation ng iyong account. Ang iyong bagong BPI savings account ay ia-activate sa loob ng 24 hanggang 48 oras.Applying for a BPI Savings Account. . Access to more than 3,000 Express Teller, Bancnet, and Expressnet ATMs all over the Philippines, and to around 800,000 Cirrus ATMs all over the world. . Remember to .Types of Accounts. Savings; Checking; Time Deposit; Services. Forex; Fund Transfer; Bills Payment; . Experience the new BPI app that keeps getting better. DOWNLOAD NOW. Do more in just a few taps . Load prepaid accounts and ewallets. Conveniently load your prepaid accounts and eWallets. BPI QuickPay. Pay your bills right away .

4 Easy steps to open BPI easy saver savings account. 1. Go to the nearest BPI branch in your area. Tell the banker that you’re going to open a BPI easy saver account. 2. Fill up the application form and submit all necessary requirements advised by the bank teller. Make sure to double check all the information. 3.US Dollar. USD 500. Required Initial Deposit. USD 500. Required Minimum Monthly ADB. USD 500. Required Daily Balance to Earn Interest. 0.05 %. Interest Rate (Per Annum)Apply now. Loans Back . You can cash in a check at any BPI or BPI Family Savings Bank branch nationwide. Monitor transactions online. . A card-based all-in-one account that combines the features of a savings and a checking account View details Business Checking. A checking account that offers a practical way to monitor your business .

Here are the unique features and benefits of the different checking accounts from BPI. . Credit Card Application. Make your everyday spending more rewarding. Start enjoying your 365 days of rewards, rebates, and exclusive privileges. . We have a wide range of savings accounts that fit your individual needs.

wwwteershillong.com wwwShillongteer.com #teer #shillong_teer wwwtoday.com Teer Teer Teer Teer Teer Teer Teer teertoday.comeer today.com.

bpi express teller savings account application requirement|List of Account Opening Requirements